Inflation / Taxation

Tax-Deferred Investments

- Tax-deferred accounts provide an immediate tax benefit for the investor. Contributions to these accounts aren’t subject to income taxes. Depending on the type of account, either your contributions are withheld from your paycheck before taxes or you can deduct your contributions when you file your income tax return.

- In fact, you won’t pay taxes on the money in your tax-deferred accounts until you withdraw it, usually during retirement. When that day comes, you’ll pay income taxes on your distributions. But if you meet the distribution requirements for the particular type of account, you won’t be on the hook for any additional taxes or penalties.

The Short Version

- A tax-deferred account allows you to defer taxes on your income and investments until a future date, giving you an immediate tax benefit.

- Tax-deferred accounts are different from tax-exempt accounts, which require taxation upfront but are exempt from taxes in the future.

- One of the most popular types of tax-deferred accounts is a retirement account, including 401(k) plans, 403(b) plans, 457(b) plans, and IRAs.

- Other types of tax-deferred accounts include tax-deferred annuities, permanent life insurance, and health savings accounts.

** Tax-Free Investments **

Simply put, tax-free investing refers to any investment in which the interest, dividends, or capital gains are exempted from federal, state, or local taxes. This type of investment can be a powerful tool in your wealth-building arsenal, helping to maximize returns and minimize the impact of taxes on your overall financial picture.

Municipal Bonds

Indexed Universal Life (IUL)

Roth IRA

Roth 401(k)

The 3 Tax Buckets

Tax Now

CD’s

Stocks

Mutual Funds

Money Markets

Bonds

ETF

Tax Later

401k | 457

403b | IRA

SEP IRA

Simple IRA

Pensions

Annuities

Tax Exempt

Roth IRAs

Municipal Bonds

Cash-Value Life

Insurance

IT’S YOUR MONEY!!

Higher Risks = Higher Rewards & Bigger Potential Losses

Lower Risks = Moderate Rewards & Guarantee Floor / Cap on Losses

The sooner you move from Tax Now & Tax Later Buckets to the Tax-Exempt Bucket with your Investments (Money) the more control you have providing the Retirement You Want.

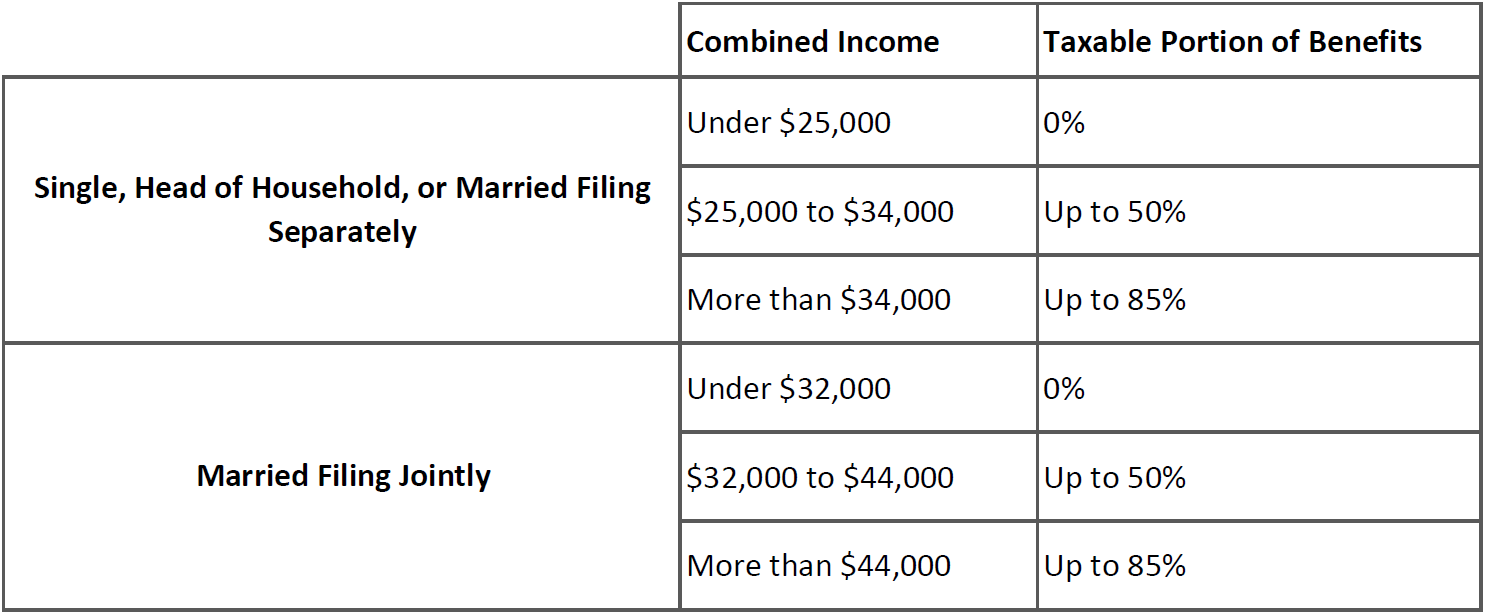

Think about moving to Tax Exempt Plans Before taking Social Security